Wisr Today

GFP implemented a lifecycle marketing automation system for Wisr Today, driving a 38.89% increase in user journey engagement and scaling communications from 60K to over 3.5M per quarter fueling significant user growth and retention.

4.8 ★

Top 20 in App Store

70%↓

Decrease in Cost Per Install

20%↑

Increase in user engagement

“[GFP] has a deep understanding of the customer journey.

He's able to identify and capitalise on key growth opportunities.

He's a master of leveraging data to inform his decisions, and he's able to develop and execute effective marketing campaigns that deliver measurable results.”

- Elaine Lee, Product Owner

Wisr Finance

Client

Year

2023

Background

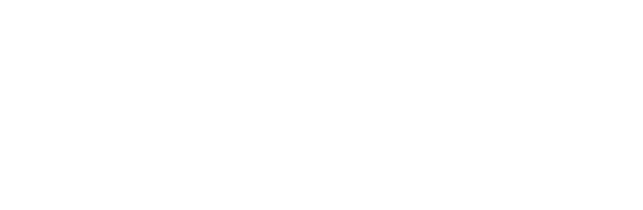

Wisr Today launched as a world-first psychology-driven fintech app, utilising Cognitive Behavioural Therapy (CBT) methods to help users build better financial habits. The app stood out by integrating psychological science into money management, with personalised coaching and habit tracking.

Challenges

- Low conversion from registration to trial start (15.8% in Month 1)

- Limited user lifecycle engagement and retention

- Scaling user acquisition with limited budgets

- Competitive app landscape requiring standout ASO and sentiment management

Key goals

- Improve trial conversions and engagement through optimised user onboarding and habit coaching journeys.

- Build a robust lifecycle marketing automation system to improve activation and retention.

- Scale user acquisition with cost efficiency, while testing creative strategies across Meta, Google, and ASA.

- Boost app discoverability with an impactful App Store Optimisation (ASO) strategy.

Strategy

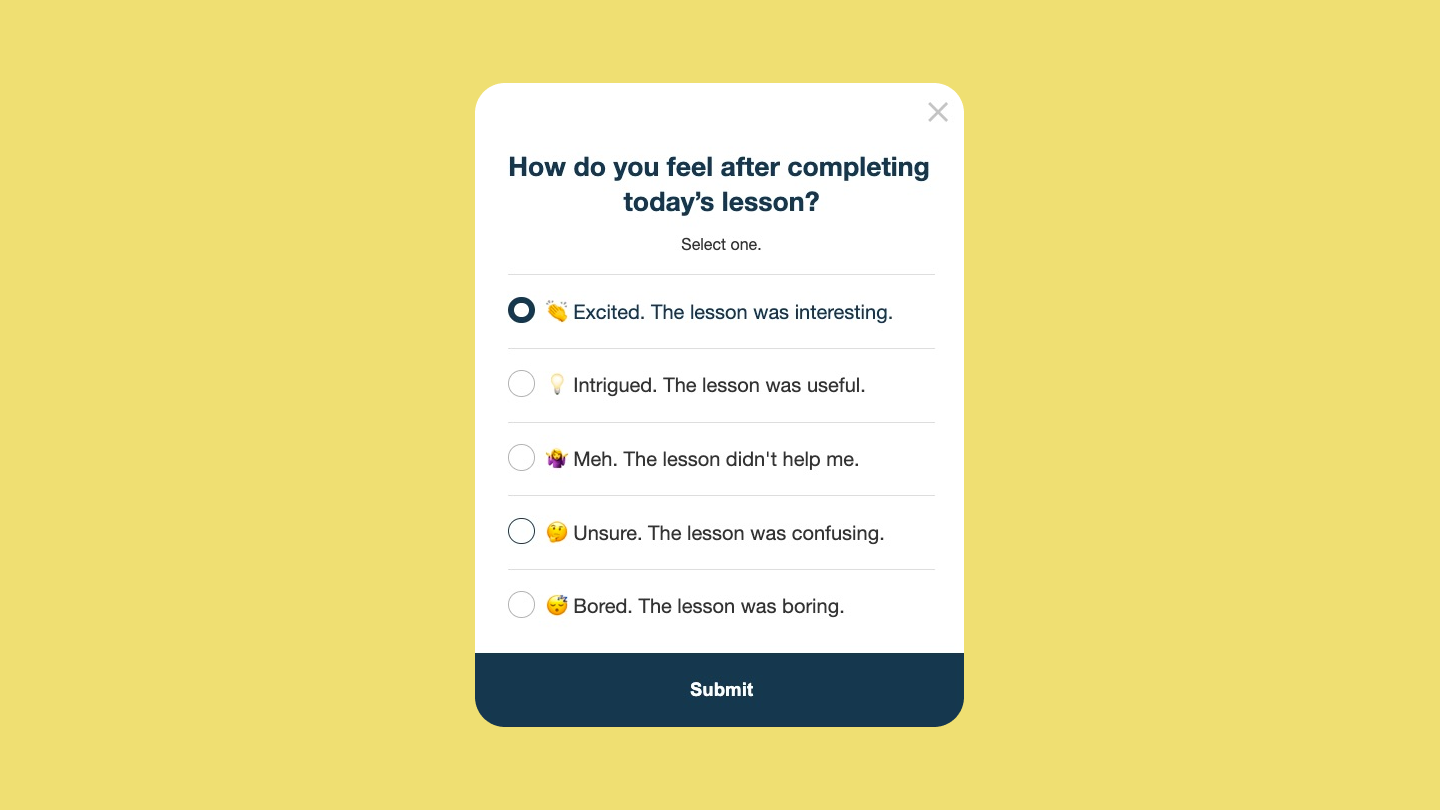

Our strategy for Wisr Today centered on optimising the onboarding experience and building a robust lifecycle marketing automation system. We streamlined the sign-up process to reduce friction and make the value proposition immediately clear. We also implemented personalised journeys powered by Braze, delivering tailored content at the right moment to foster user engagement, retention and long-term commitment.

Boosting trial starts

STRATEGY HIGHLIGHTS

Our first priority was to make sure as many people as possible were signing up for a 7-day trial. The onboarding process was identified as a critical touchpoint that could either encourage or deter users from starting their journey. In the original version of the app, friction in the early stages of use led to a high dropout rate, particularly during registration and the transition to trial.

To address this, we implemented an onboarding redesign that simplified user interactions and focused on making the first moments in the app as seamless as possible. This involved

reducing cognitive overload by streamlining the sign-up process and clearly communicating the value proposition

from the outset.

A more intuitive and frictionless onboarding experience increased the likelihood that users would engage with the app immediately, helping to drive conversion from registration to trial start from 15.8% in Month 1, to 25.3% in month 3.

Scaling Lifecycle Marketing

STRATEGY HIGHLIGHTS

Wisr Today needed to establish a strong lifecycle marketing strategy that could foster user activation, retention and re-engagement with users. To do this, a comprehensive automation system was designed to deliver the right message at the right time based on user behaviour and engagement. This system took users on a journey that started with immediate onboarding support, followed by tailored financial advice and habit-coaching prompts.

These personalised journeys were carefully calibrated to nudge users towards key milestones, such as setting up savings goals or tracking spending, while offering ongoing support to encourage long-term commitment. By automating these journeys, Wisr was able to engage users without overextending resources.

The ability to personalise content at scale not only enhanced user experience but also increased engagement, as users felt supported and understood throughout their financial transformation.

This strategy drove a 20%+ increase in user engagement, keeping users consistently involved with the app and reinforcing their financial behaviours through timely, personalised interventions. It also increased the audience size and communications sent from 60K to over 3.5M per quarter, with a rise in user journey comms engagement from 9% to 12.5% – primarily using organic methods.

The result was a more engaged user base that was more likely to convert from trial to paid membership and stay active over time.

Optimised UA Strategy

STRATEGY HIGHLIGHTS

With a limited marketing budget of AUD $350K per quarter, Wisr faced the challenge of acquiring users cost-effectively in a competitive market. The solution was a highly optimised user acquisition (UA) strategy that focused on rigorous testing and data-driven decisions.

Through A/B testing, Wisr refined its approach to audience segmentation, creative messaging, and channel selection. This iterative process led to a significant reduction in cost per install (CPI), dropping by over 70% in just three months. By identifying the most effective channels—such as Meta, Google, and Apple Search Ads—and allocating budget more efficiently, Wisr maximised the return on investment for every dollar spent.

The strategic use of organic channels, such as influencer partnerships, also contributed to reducing reliance on paid acquisition, further driving down CPI and increasing the app’s overall cost efficiency.

ASO & Sentiment Management

With a highly competitive fintech landscape, ensuring Wisr Today’s visibility in the App Store and Play Store was critical for sustained growth. To enhance discoverability and user trust, we developed a robust ASO and sentiment management strategy.

By refining keyword strategies, optimising metadata, and improving creative assets, Wisr Today consistently ranked in the top 20 in the App Store with a 4.8-star rating and in the top 10 in the Play Store with a 4.4-star rating.

Additionally, we actively managed user sentiment by responding to feedback, addressing concerns, and implementing improvements based on user insights.

This proactive approach not only boosted ratings but also fostered trust and long-term engagement among users.

Our work with Wisr Today drove substantial improvements in user acquisition, engagement and retention, establishing it as a standout innovation in fintech habit coaching. The app also empowered users to take control of their financial habits, helping them save real money and build confidence.

*While Wisr Today’s journey evolved with shifting business priorities, its impact remains – demonstrating how psychology-driven financial tools can create lasting, meaningful change for users.

Ready to Grow?

Get in touch to book in a call, and make sure to check out our case studies showcasing some of our recent impact!